HOW DID YOUR INVESTMENT PORTFOLIO PERFORM DURING THE COVID-19 CRISIS?

Do you have a solid strategy? Did you panic?

The past few months have been a real roller coaster ride in the stock market. Many people are fearful of the volatility in the stock market and are irrationally driven by fear to cash out of their strategy and become less inclined to invest in the future. In a March 2020 survey of registered voters cited by Statista, over one-third of adults reported that they were less likely to invest in the stock market based on what they knew about the coronavirus. Only 12 percent of respondents said they were more likely to invest. Hmmmm…. I think these statistics demonstrate panicked and NOT prudent decision making.

How does our behavior and psychological state affect our investment strategy?

Most people believe that market movement is dictated primarily by traditional economic theories, but that theory is a fallacy. Behavioral economics reveals that stock price movement is frequently influenced by emotional decisions made by investors, not rationality. During increased volatility such as the Covid-19 pandemic, investors make more decisions based on emotions, bias, and fear, and not rational, unemotional decision making. The three key biases that become prevalent during market turbulence are affect, herd behavior, and loss aversion. What are these biases and what should we look out for in our own decision making?

“Affect” is when we short-cut the decision making by letting good or bad feelings influence us instead of logical responses to information. During market turbulence one of the most prevalent emotions to surface in investors is fear! During a sudden drop (remember March 9th and March 12th of this year?), overwhelming fear is triggered by panic in many investors and they over-estimate the risk of losing their money permanently. If they have a diversified portfolio and a long-term strategy, this is an irrational fear that could cause permanent capital loss if the fear causes them to liquidate at lows.

“Herd Behavior” is when we act like sheep and do what everybody else seems to be doing rather than making decisions based on knowledge, information, and rationality. With incessant media coverage and fear-mongering, investors stay glued to their televisions and think they should do what everybody else seems to be doing, or at least what the media is saying everybody else is doing. Collective pessimism can lead to stock prices crashing regardless of their fundamental values. We might as well be sheep with behavior like that.

Finally, “Loss Aversion” is the result of people not feeling gains and losses equally. We experience losses twice as strongly as gains—if we lose $100 it hurts exponentially more compared to the good feeling we have if we gain $100. Loss aversion makes us want to avoid risk and will cause us to make conservative changes that may not actually be aligned with our long-term goals. By definition, investing involves risk, and as the historical facts reveal, even with dips, long-term investing is the most efficient route to growing one’s capital.

Let’s look at the actual facts – the real deal

Fact: There is no reward without risk. Period.

This factoid does not mean throwing caution to the wind and treating the stock market like Las Vegas and taking on outsized, irrational risks. Risk involves uncertainty but with unemotional decision making based on fundamental analysis, risk can be managed and be used to create opportunity.

As an investor, we must learn to stomach volatility. Covid-19 initially caused a very short and intense drop in the market with a quick recovery. That said, there continues to be intra-day volatility. For example, on June 15th, the market was up approximately 750 points at opening, up 250 points mid-day, turned negative, and then rallied to close positive at 157 points. Clearly focusing on intraday movements is exhausting and really is not indicative of long-term results.

Fact: The S&P 500 Index had an average annual return of 11.81% from 1980 through year-end 2019.

Wow! That sounds like a great annual return, right? Yes, it does, but let’s put it in context. During that time period, there were up years and down years, and the index returned between 9% and 12% annually only three times during that time period. Usually, it was above or below the average annual return of 11.81%, and sometimes significantly.

Source: Hartford Funds, March 19, 2020

We need to be long-term players so returns that fluctuate yearly are given the time to grow and produce solid “annual returns” over time. What is the definition of “annual return”? “An annualized total return is the geometric average amount of money earned by an investment each year over a given time period.” The operative words to focus on are “over a given time period”. Many investors don’t remember that volatility whether a week, a day or a year, is historically very short-term. Patience is your friend in the stock market, and if you reframe your point of view to look at short-term volatility from a long-term perspective, it will totally change its significance to you. If $10,000 was invested in 1980 at an 11.81% average annual return, the $10,000 had grown to $870,281 in 2019 even though as you can see from the chart above, there was occasional volatility along the way. Clearly, having patience and not reacting emotionally paid off if you stayed the course with your $10,000 investment.

Source: Hartford Funds, March 19, 2020

Fact: Volatility can provide opportunistic gain if approached with rational behavior and a solid strategy driven by fundamentals.

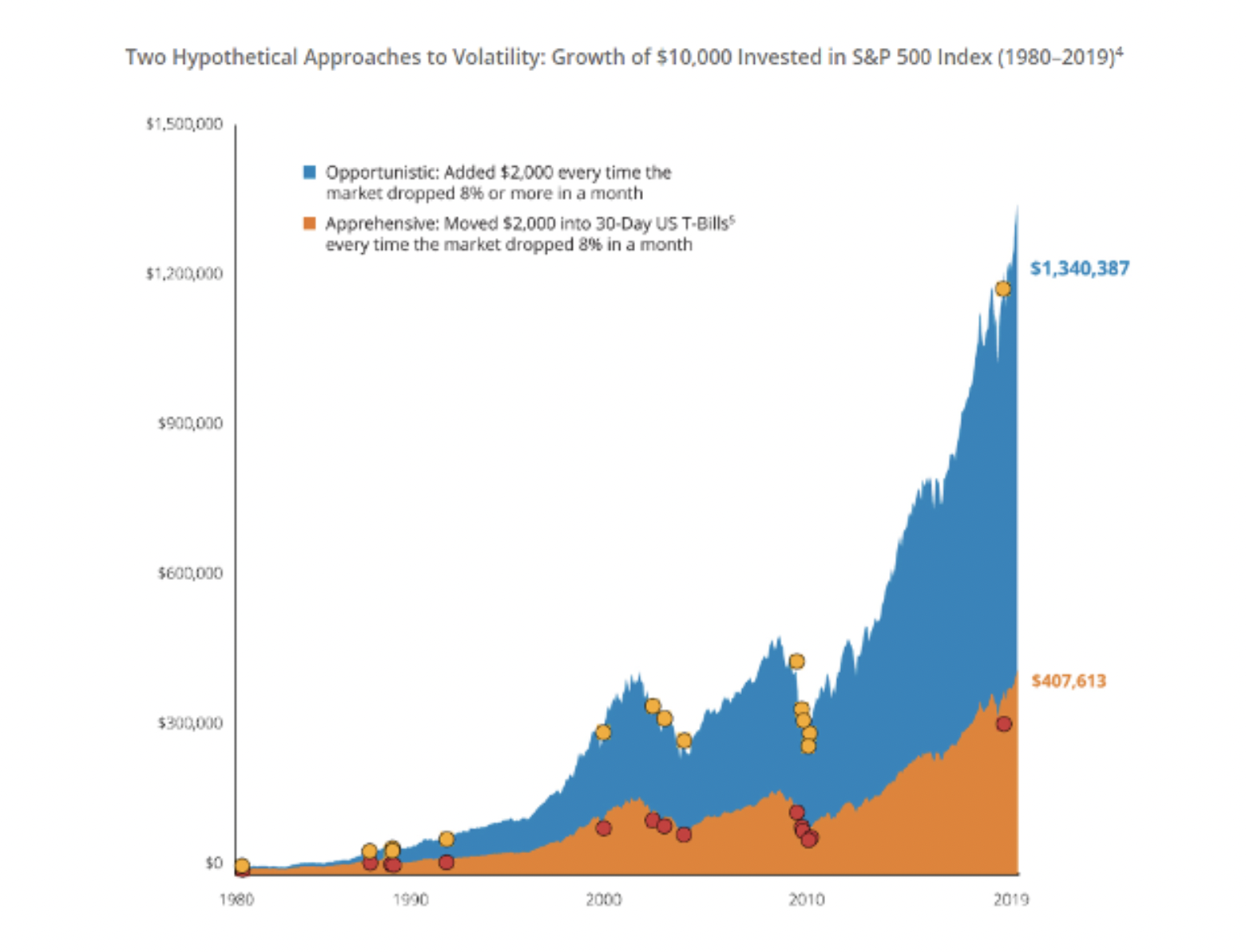

Staying with the example above, if we have two investors who both invested $10,000 on 12/31/1979, with one investor (opportunistic) who invested during a market drop of 8%, and the other investor (apprehensive) who shifted assets to cash or safer investments, the opportunistic investor’s strategy resulted in a significantly greater investment value in 2019. The opportunistic investor had an investment valued at approximately $1.3 million in 2019 and the apprehensive investor’s investment was valued at approximately $408,000 in 2019. The path chosen definitely had consequences to the long-term outlook and future retirement prospects.

Embracing Volatility –Eyes Wide Open. NO FEAR!

The upshot is that volatility is our friend. I am not saying that it doesn’t cause trepidation but what I am saying is that the historical facts support the thesis that having a solid long-term investment strategy and riding out the short-term dips along the way, bears fruit that one cannot achieve in cash or conservative investments. Volatility simply is the price movement of an investment and the facts show that it is not permanent. Since 1949 there have been nine periods of 20%-or-greater declines in the S&P 500. The average 33% decline of these cycles can be painful to endure, but missing out on the average bull market‘s 268% return is even more painful. Most bear markets have had a relatively short duration (14 months on average), which also makes trying to time the market in the short-term a fool’s errand full of unpredictable outcomes.

The Dangers of cashing out at lows: Sequence of Returns Risk

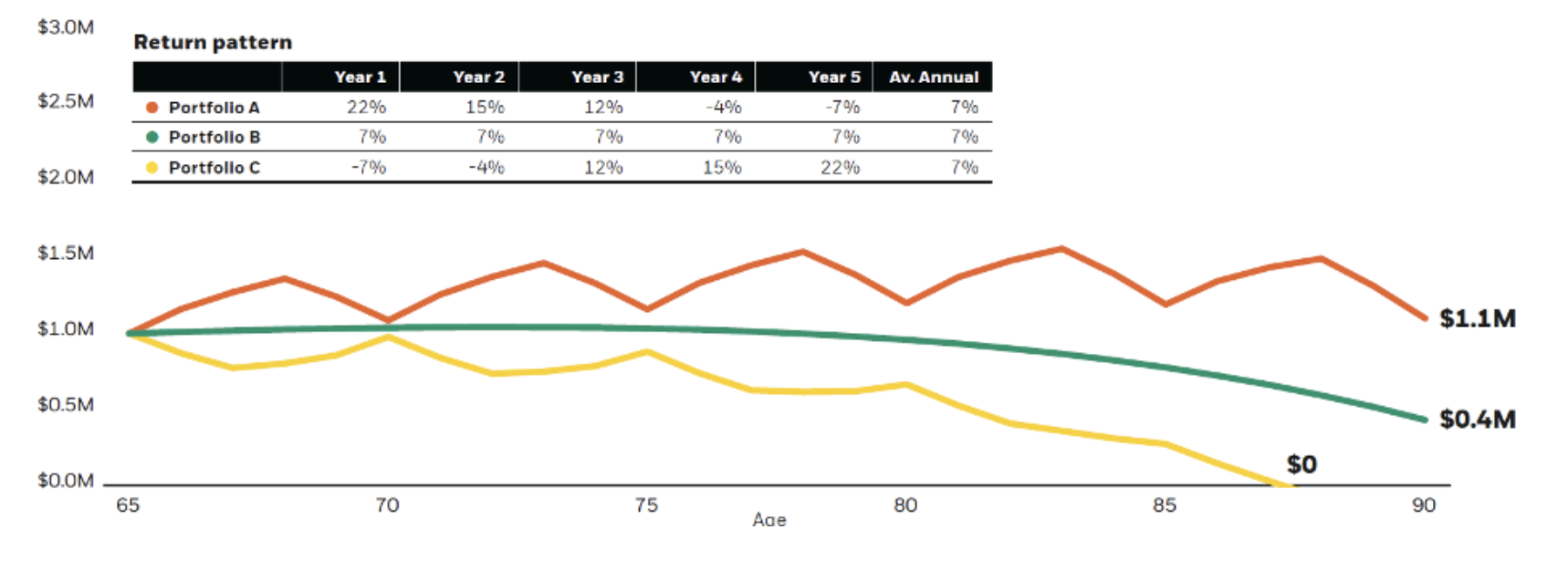

Sequence-of-return risk is the danger that the timing of withdrawals from an investment account will have a negative impact on the overall rate of return available to the investor. Typically, this is a major risk for a retiree who depends on the income from a lifetime of investing to live on during retirement and who no longer is contributing new capital that could offset losses. However, this significant adverse effect holds similarly when an investor is considering withdrawing during severe market downturns. As was previously discussed, portfolio withdrawals compound losses, making it harder and taking longer, to recover from a portfolio decline, especially one that comes early in the sequence. If an investor takes out $60,000 per year when there is a downturn (Portfolio C), the effect is very detrimental to the longevity of the portfolio.

Source: Blackrock.Com

The above chart illustrates that the same three portfolios react very differently to withdrawals during varying market conditions.

Enough said…What is the strategy to endure volatility and not lose money permanently? Diversification, Fundamentals, and a Disciplined Long-term strategy, of course!

Diversification is a technique that reduces risk by allocating investments among various financial instruments, industries, and other categories. It aims to maximize returns by investing in different areas that would each react differently to the same event. But please note that it may come with lower rewards in the short-term because the risk is mitigated. Although it does not guarantee against loss, diversification is the most important component of reaching long-range financial goals while minimizing risk and volatility within your portfolio; that said there will always be some level of volatility.

The goal of diversification is not really to boost outsized performance, but it does have the potential to improve returns whatever risk level you choose. If one portion of your portfolio is declining, it may ensure that other portions are not declining or not declining as much. It is best to have a mix of stocks, bonds, and alternatives in your portfolio. Alternatives are investments that are uncorrelated to the broad stock market, i.e., they do not necessarily move in the same direction as the stock market and can include liquid hedge funds, hedge funds, REITs, private equity, and other options.

Source: The Bahnsen Group 2020

Focus on the fundamentals of companies when stock investing. Remember that buying stocks is buying ownership in a company. Does the company have cash flow, too much debt, good management, and are they allocating funds for capital expenditures and shareholder return and dividends? Also, be mindful of overconcentration in one stock – probably prudent not to have one stock make up more than 5% of your portfolio.

With respect to bond investments, consider varying elements such as maturities, credit qualities, and sensitivity to interest rate changes.

Once you have your mix, on a regular basis check the weightings of each allocation to make sure that they still make sense given current market conditions; from time to time you should rebalance your allocations.

And finally, don’t try to market time and have a short-term strategy. Market timing is impossible and very risky. Be a patient, long-term investor. Do your research and be intentional in your investing. I would also recommend consulting with a reputable investment advisor who is a fiduciary, if possible, as they can give you advice on your strategy given your time horizon, risk tolerance, and long-term goals.

My take:

Panic and fear are not your friends.

The facts of the benefits of long-term, disciplined investing speak for themselves.

Be intentional in your strategy and diversify your allocations.

Do your research, and don’t act like a sheep.

Don’t make emotional investment moves.